How pay-as-you-behave technology could transform car insurance

And your pay-as-you-behave score is...

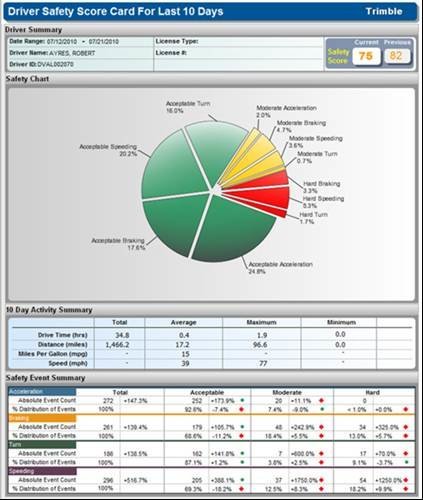

After an agreed fact-finding period, insurance companies and management teams can review a scorecard outlining how that individual has been driving. The breakdown of information is then collated into an individual safety score from which insurance companies can adjust premiums accordingly based on a “pay as you behave” approach. The score card also allows businesses to review drivers on an individual basis and suggest areas for improvement.

As of December 2012, gender-based car insurance calculations must be scrapped, following a recent European court ruling.

Technology is emerging which means that drivers, no matter what age or sex, could be charged a premium based on how well - or badly - they drive, putting them in control of how much they need to pay. This technology developed by telematics expert Trimble evaluates the way in which people drive by monitoring the manoeuvres made during a journey – so it will be able to detect harsh manoeuvres such as hard braking and swerving as well as speed.