tilialucida - stock.adobe.com

Internet giants in favour as Ireland tightens rules on datacentres

Irish premier Michael Martin has insisted its temporary squeeze on datacentre construction is not a moratorium on the industry

Emergency restrictions on datacentre investment have become government policy in Ireland, creating some respite after botched planning left its electricity grid too weak to support its fastest-growing industry.

Announcing the policy in casual comments to national media while on a state visit to Japan in July, Irish premier Michael Martin insisted its temporary squeeze on datacentre construction was not a “moratorium” on the industry that has driven its decade-long export boom: Ireland was still open for business.

Yet now, eight months since Ireland’s electricity grid regulator imposed such strict controls that it created an effective ban on new projects in Dublin, the Irish capital that hosts one of Europe’s largest industries, Taoiseach Martin’s government has endorsed it in a formal government policy.

The landmark grid regulation, which in November 2021 forbade construction of any datacentres bar those that could generate all their own energy onsite, granted breathing space not only for Ireland’s power supply, but for the cloud computing corporations that dominate its industry, while they perfect breakthrough technologies they have been developing to mitigate their demand for electricity.

Most pertinently for Ireland, those innovations include huge electric batteries that draw electricity from the grid when wind is high and windpower is overabundant, and feed that same energy back when renewable sources are low and the grid would otherwise be forced to burn fossil fuels to generate power.

Taoiseach Martin said in Tokyo that Hitachi, a Japanese energy conglomerate developing battery power systems for s, lobbied him to lift the construction ban, because its business depended on Ireland’s data boom continuing unabated.

Hitachi was ready to deploy battery power systems, it told a public consultation on Ireland’s construction squeeze last year, and government should pave its way.

Battery systems

Microsoft, Ireland’s largest datacentre operator, presaged the premier’s words with a declaration about battery systems it had been developing in collaboration with US-Irish power conglomerate Eaton. It was also working with EirGrid, the Irish state-owned grid operator that lobbied for a moratorium last year, with claims that datacentres would starve the grid of capacity unless Ireland’s grid regulator helped it find some way to temper demand.

EirGrid raised the alarm on power consumption after its own botched investments in Ireland’s power grid precipitated a power crisis last year. That and other handicaps left Ireland’s electricity grid short of 2,000 megawatts of electricity generating capacity – more than is used by Ireland’s entire datacentre industry, and almost half the peak power demand of the entire country.

The operator had meanwhile been nurturing a variety of international engineering firms in pioneering efforts to build batteries to store renewable energy and help power datacentres. Eaton and Enel X, an Italian power management firm with which it is collaborating, are among them.

Ireland’s booming data industry has, however, generated competition for scarce land, and for contracts to reserve limited capacity on the electricity grid, as developers vie for the resources the internet giants need to build more industrial, “hyperscale” datacentres and satisfy growing demand for data services.

“The hyperscalers don’t like that – they would prefer to get their own power and do their own thing,” David McAuley, founder of research firm Bitpower, told Computer Weekly.

Cloud corps and government officials branded Ireland’s entrepreneurial developers “speculators”, who had created an artificial power crisis by securing contracts for grid capacity in the hope, they implied, of subletting it to the cloud corporations.

The speculators held grid capacity they weren’t using, while other companies that wanted to actually use the capacity were now being told they could not have it. There was no datacentre crisis, they told the moratorium consultation convened last year by Irish grid regulator the Commission for Regulation of Utilities (CRU). The crisis was EirGrid’s deficient supply and its mismanagement of the electricity market, they said.

Usage revelation

Ireland’s problem was illustrated by the revelation that datacentres used only 25% of the capacity they reserved on the grid. The majority of power declared to be critically short was merely set aside.

Grid capacity is under-utilised, said McAuley, because the firms that hold it cannot usually control whether customers rent computing power, nor how much they actually use when they do.

Three-quarters of Ireland’s capacity is held by cloud corps, according to Bitpower. Retail and wholesale companies hold the rest. But in Ireland they typically sell their capacity to the cloud corps anyway, said Garrett McClean, an executive director at real estate firm CBRE.

Implementing CRU’s regulatory squeeze this year, EirGrid tore up about 30 applications developers had made to secure power for datacentres they hoped to build in the next decade. It refused to identify them.

But they included “hyperscalers, carpetbaggers, speculators, real estate investors and anyone who has got a bit of land and an electricity connection,” Garry Connolly, president of industry association Host In Ireland, told Computer Weekly after EirGrid leaked details of the cancellations to the Irish press.

To complicate matters, it can take 10 years for a firm to build a datacentre once it has secured a reservation for grid capacity, according to EirGrid.

Utilising reserved capacity

The cloud corporations ignored requests for comment, but Facebook parent Meta used nearly 70% of capacity reserved at its hyperscale datacentre in Ireland last year, something that became apparent after it recently disclosed the power consumption of its hyperscale datacentres. However, the firm took five years to build the datacentre to utilise its reserved capacity. In 2018, it used only 21% of its contracted power, by Computer Weekly’s calculations. In 2017, it used 0.1%, though year-by-year, its utilisation grew considerably.

The cloud corporations told the CRU it should reform Ireland’s electricity market to penalise companies that held capacity but did not use it quickly. EirGrid and the CRU claimed applications for grid capacity had become rampant.

Yet with scant evidence from either the industry or the regulator and operator, it was hard to follow the finger of blame in Ireland.

Parroting EirGrid’s critique of growth last year, the CRU justified its squeeze on growth by claiming they used an unreasonable amount of energy in relation to the economic benefits they bring, and a disproportionate amount in comparison with other industries.

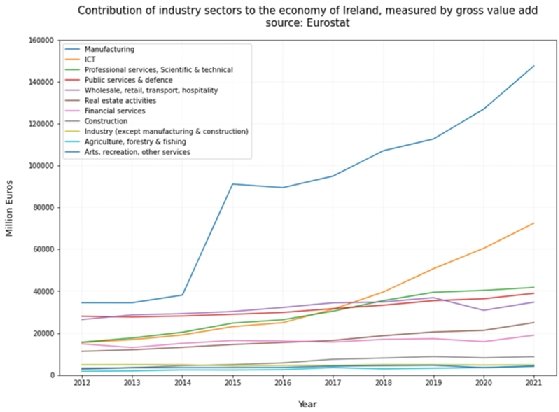

The industry, of which its datacentres are an integral part, were the engine that kept Ireland’s economy growing through its closedown at the height of the coronavirus pandemic, according to official figures published by Eurostat.

It is a primary reason for predictions that it will be the fastest-growing economy in the world for the next few years.

Ireland’s booming datacentre economy

Ireland’s manufacturing sector, dominated by pharmaceuticals and chemicals firms, has had such astounding growth since 2014 that it makes the rest of the economy look flat.

But other sectors have in fact been booming, too. Construction, professional services, agriculture and real estate all doubled their output in the past decade. Other sectors all grew a third in that time, with the exception of only its energy, water and mining companies.

Ireland’s ICT sector, driven by its industry, has grown fastest in the past five years. Weak electricity sector companies singled it out for sanctions, claiming its growth alone was too much for the country’s power infrastructure to bear.

Yet it's chemicals and pharmaceuticals sectors grew almost as much, were always larger and still dominate the Irish economy by far.

EirGrid portrayed industry growth as a problem, though it has forecast that growth since at least 2018, and as recently as 2020 stated it was no problem at all.

Datacentres should not be singled out for scrutiny or made into scapegoats, Taoiseach Martin, the internet giants, and the Department of Enterprise, Trade and Employment (DETE) all stressed, in apparent reference to CRU and EirGrid’s assertions, and the furore that has raged subsequently in press and parliament.

Datecentres kept the country running digitally during its coronavirus lockdown, and are now helping the rest of the economy as it transitions from the physical, fossil-fuelled processes of the past to more energy-efficient, digital means, such as remote meetings, digital public services and computer-enhanced business processes.

EirGrid and CRU’s assertions, however, premised on selective analysis, singled out datacentres and withheld information about the power reservations in Ireland’s giant manufacturing sectors.

Ireland nevertheless had capacity left for no more than about three datacentres, said the government policy, to a total of about 300MW, outside Dublin. Ireland would give existing operators preference over it. "We have to avoid speculative datacenters - ones that are built and then are looking for clients. That's something we're not in favour of," Martin said in Japan.

Ireland would meanwhile pursue its plan to build offshore windpower generators, to replenish its deficient, fossil fuel-dominated electricity supply, and meet a target to generate 80% of its supply from renewable sources by 2030.

Catching up with demand

Speaking again to journalists in Singapore a fortnight ago, Martin portrayed Ireland’s non-moratorium as a respite, of just “two or three years”, for Ireland’s windpower industry to catch up with datacentre demand, according to a press conference transcript his office released to journalists.

His policy singled hyperscale datacentres out for favour, by definition if not by name, for their longstanding investments in windpower, for their contribution to the Irish economy, for building industrial-scale electric batteries into the electricity grid, for systems by which they propose moving their computer processing loads around their global infrastructure to wherever renewable energy is most plentiful at any given time, and for their public commitments to become zero emitters of greenhouse gasses.

Ireland’s policy even made the CRU’s non-moratorium more stringent. Where the regulator said new datacentres must generate their own power onsite, DETE said fossil-fuel generators would not be permitted. Battery storage was the only alternative if a developer did not simply build next to a renewables farm.

Hyperscalers had protested the sanctions would force datacentres to build fossil-fuel generators, while Ireland’s Industrial Development Agency insisted windpower expansion would keep pace with demand without any intervention.

Martin said favoured companies would now “take great comfort” from Ireland’s guarantee that it would have the windpower they sought when the current crisis passes in five years’ time.

Ireland’s demand for green datacentre power

The Irish government’s policy added further strict conditions on the construction of datacentres than even those its electricity grid regulator imposed last year.

The Commission for Regulation of Utilities, the regulator, imposed controls on development of datacentres in November 2021, decreeing that developers would be refused reservations for grid capacity needed to build new datacentres unless they met certain conditions.

New datacentres should have small power plants of their own, onsite, to satisfy their entire demand for electricity, it said, among other things.

Ireland’s industry had responded to the regulation with plans to build fossil gas generators, using Ireland’s most abundant power source, but the rule raised protests from environmentally progressive cloud corporations that are striving to eliminate their carbon emissions entirely.

It had, however, envisaged that the industry would eventually use renewable gas – bio methane, produced by concentrating methane gathered from rotting organic waste, wastewater or livestock. The proposal corresponded with Ireland’s large dairy industry, the emissions from which are the cause of another national environmental alarm.

Moreover, it coincides with a plan for Ireland to become so abundant in renewable electricity generated from its ample offshore wind resources that it not only becomes a net exporter of electricity, but that it gets power to produce hydrogen as well, and produce another green energy resource to power datacentres and other demanding industry sectors.