Reforms needed to tackle economic crime, says Treasury Committee

The Treasury Committee is disappointed at progress towards tackling economic crime and fraud in both the online and offline worlds, and is calling for more action

Such is the scale of economic crime and fraud facing UK consumers and organisations that urgent reforms to policing, alongside new legislation, are now needed to tackle the problem, according to the cross-party Treasury Committee.

In a report published today, the committee called on the government to take steps to tackle the problem by: appropriately resourcing law enforcement, possibly creating a new specialist economic crime agency; regulating the crypto sector; legislating against fraudulent adverts; implementing legal protections to guarantee that victims of authorised push payment fraud are reimbursed; and mandating higher company formation fees and Companies House reform to stop malicious actors masking their identities behind UK businesses.

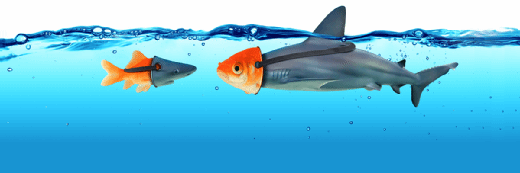

Committee chair, Conservative MP Mel Stride, said: “For too long, pernicious scammers have acted with impunity, ripping off innocent consumers with fraudulent online adverts, impersonation scams and dodgy crypto investments.

“Unfortunately, fraud has soared during the pandemic, and as MPs we’ve heard heart-breaking stories of individuals who have fallen victim to these criminals and lost large sums of money.

“While the government have made some progress in this area, we’re today calling on them to push harder and act faster on the growing fraud epidemic. Some of our recommendations, such as legislating against online scam adverts, can be implemented quickly.

“Others, including crypto regulation and Companies House reform, will require a longer-term approach. Taken together, our proposals give the UK a fighting chance to get back on the front foot and stop these scammers in their tracks.”

The report comes in the wake of two reports published by the previous Treasury Committee before the 2019 General Election, and as such also serves as a progress report to gauge the effectiveness of measures implemented since then, and of the Economic Crime Plan 2019-22 put in place at the time.

The current committee said that since 2019, economic crime had continued its upward trajectory, citing ministers who told it they were unhappy with the government’s response to tackling it. It recommended that the government now set out a relevant planned programme of legislation, assess what measures an Economic Crime Bill could bring in, and queried why it had not yet chosen to bring forward such a bill.

The committee said there was an opportunity this year for the government to review how well the Economic Crime Plan has operated and adapt it, as necessary, for an additional three-year period. The committee anticipates that the government will use the opportunity to “push harder and faster” and said this would be an ideal opportunity to consider centralising policy responsibility in a single department or agency.

Currently, said the Treasury Committee, economic crime does not appear to be a priority for law enforcement, with a “bewildering” number of agencies having some degree of responsibility for tackling it. Appropriate delegation of funding and the creation of a single agency may address that.

It also urged the government to include measures to address fraud via online advertising in the Online Safety Bill, extending financial services advertising regulations to online companies, and giving the Financial Conduct Authority powers to enforce them.

The committee said online companies should not be allowed to profit both from paid-for advertising for financial products and for warnings issued on their platforms by the FCA about those advertisements, and encouraged all online companies to work with the government and public sector to combat online scams and fraud.

On the regulation of crypto assets and services – many of which are little more than thinly disguised pyramid schemes, with thousands losing money to grifters and fraudsters – the committee said it welcomed the Treasury’s proposals to bring advertising of crypto in line with other financial products, and actions on this subject by both the Advertising Standards Authority and the FCA. It urged the government to ensure proper consumer protection regulation, and to take steps to force crypto firms to register for anti-money-laundering purposes.