asiandelight - stock.adobe.com

IT Priorities 2020: SD-WAN soars as collaboration and communications no longer on back burner

At the start of the year, networking professionals looked likely to invest in monitoring, converged architectures and WAN technologies, while unified communications was in decline and collaboration of minimal interest

For IT professionals, it could well be that 2020 was the year of three months. As regards networking and communications, up until the end of March 2020, there seemed to be a consensus on how the year would pan out, with firms increasingly investigating how they could best take advantage of 5G networks, how access to full-fibre networks could improve the business and whether Wi-Fi 6 was appropriate.

There were, of course, remote conferencing and collaboration tools available, but these were, as they had been for a while, not much of a priority. There was a need for them, but not a pressing one. How far away those days seem now.

The outbreak of Covid-19 has changed everything and, in terms of networking, has turned everything upside down. Remote conferencing and collaboration are now, without any exaggeration, business necessities and, as witnessed by the recent takeover of BlueJeans Networks by Verizon, is just as important to the supplier community as it is to users.

By contrast, the 5G industry is suffering from a number of blows. Its prospects are particularly vulnerable in countries that have undertaken lockdowns for indefinite periods to prevent the spread of the coronavirus and which are likely to see severe economic slowdowns for which 5G will be an expensive luxury not a necessity.

Changing priorities

So, the world has changed immeasurably. But perhaps to get a fuller picture as to how Covid-19 is going to hit the networking and communications industry, and its subsequent knock-on effect for networking professionals, it is necessary to know what was on professionals’ agendas as 2020 began. And the 2020 Computer Weekly/TechTarget IT Priorities survey revealed exactly what these priorities were.

Overall, the global research surveyed the opinion of UK and Irish IT professionals across 10 main industries, namely financial services, telecoms, hospital and healthcare, government administration, retail, manufacturing/industrials, business services, managed service providers and management consulting. Just over two-fifths of these firms (44%) had 1-99 employees; 22%, 100-999; 14%, 1,000-9,999; and 20% more than 10,000.

The research found that while companies’ budgets for IT were softening overall – 39% said that they were going to be spending more money, representing a 28 percentage point fall compared with the start of 2019 – they were moving towards a number of key areas, including networking. Indeed, the survey found that networking was getting what the researchers called “a good dose” of new, and users redirected spending into connectivity and connectivity management.

End user computing was found to be collinear with digital transformation, and mobile enablement was a big deal in modernisation. And in what may be the biggest change since the coronavirus struck, managed services interest was widespread and heating up.

When asked which initiatives would most impact their organisation’s 2020 technology spending, networking was chosen by 36% of respondents, 1% above cyber security or risk management and second only to cloud infrastructure deployment, which was cited by 41%. In terms of which best described the elements within users’ IT environment that they planned to monitor, the top element was network traffic/data flow, indicated by 54%. This was followed by identity and access control, and user behaviour, with 51% and 46% respectively.

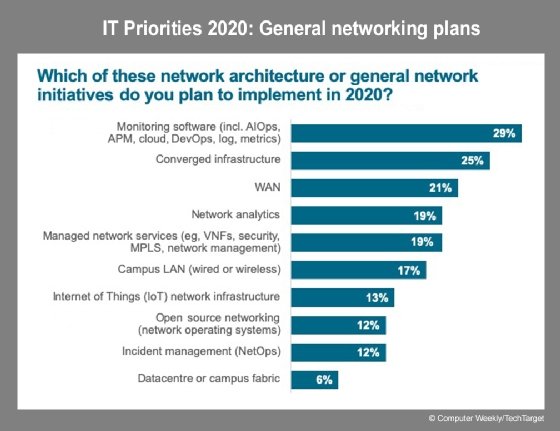

Yet when it came to which network-based initiatives that they planned to implement in 2020, monitoring software was cited as the most important by 29% of users, followed by converged architectures for 25% and wide area networks (WAN) for 21%. Campus LAN, an increasingly growing subset of the industry at the beginning of the year and an area of great interest for companies such as Cisco and Aryaka, was indicated as a top priority by 17%.

Wi-Fi 6 (802.11 ax) was one of the technology stories of 2019 and when professionals were asked which connectivity or access-based network initiatives were on their agenda to implement in 2020, it was only beaten by IP address management and monitoring (DHS/DHCP), cited by 39% and 37% respectively. Upgrading WLANs, such as upgrading access points and upgrading cable to 2.5/5G, followed with 33%. Interestingly, upgrading and importing multicloud connectivity – something that firms have rushed to do as telework rocketed – was indicated by just 24%, while 5G was noted by just 5%.

Virtual private networks (VPN) and network access control (NAC) as a networking initiative – that is supporting the ability, if not security, of remote working – was cited by nearly a third of those surveyed. While quite high in importance – fourth place – it would be interesting to see how much this has actually soared to in these days of remote working being the norm.

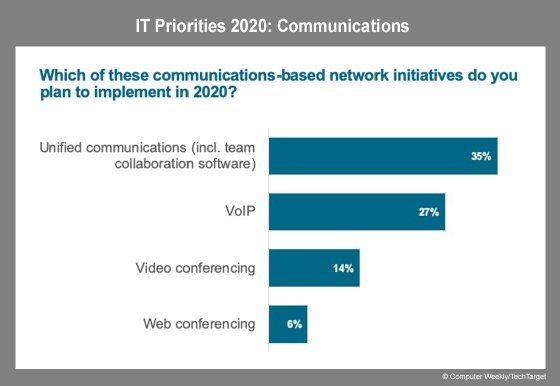

And what seems incredible now is that universal communications (UC) was spoken of as an industry with the possibility of terminal decline. Among the survey’s top-line findings was the remark that “the imminent death of UC may be overstated”. Very overstated from the vantage point of April/May 2020. The survey found that 35% planned to implement UC including team collaboration software – this target was probably hit around the third week in March if not some time before – and then VoIP (27%), video conferencing in general (14%) and web conferencing only getting 6%.

Software-defined networking in a wide area network (SD-WAN) was another of the undisputed key trends of 2019, and huge things were predicted by industry analysts for its growth this year. The survey though noted that SD-WAN interest in the UK was, at the start of the year, not as strong as North America was showing. Just over a tenth (11%) of the survey said they would implement WAN edge infrastructure, with the same percentage saying they would deploy software-defined networking (SDN) in the datacentre and 9% SD-WAN per se and on edge routers.

Despite there being plenty of opportunity for managed service providers (MSPs) and inter-cloud connectivity providers at the time the survey was conducted, the study found that just under three-fifths (57%) of surveyed firms were considering MSPs for any services.

VoIP (21% of respondents) was found to be the most popular area for a managed service, and 17% considers UC as an ideal candidate for such a service delivery, the same as for managed network services. Video conferencing as a service was considered by just 5% of the sample.

Upwardly mobile

So what about mobile? Well, again it can be said without doubt that mobility will end 2020 even more important than the industry professional thought it would be.

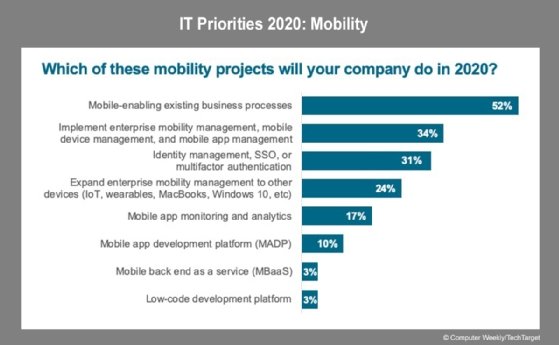

The essential issue was this: end user computing was found to be collinear with digital transformation, and mobile enablement was a big deal in business modernisation. The study revealed that there was a 63% year-on-year increase in UK and Irish companies looking to mobile-enable existing business processes.

When looking at how mobile would enable business processes and management in 2020, the survey found that 52% of respondents indicated that their business would look at mobile enabling existing business processes and 34% said they would focus on implementing enterprise mobility.

Addressing security issues for mobile was a top priority for 31%, and the next most popular, for 24%, was expanding enterprise mobility to more devices, including the internet of things (IoT) and wearables.

Read more about UK networking

- Trade body for independent network providers calls for progress toward the delivery of ultrafast broadband to all parts of the UK to continue despite the current Covid-19 lockdown conditions.

- Study reveals consumer appetite for advanced messaging functionality, but operators must place privacy, security and person-to-person functionality at the core of new messaging services.

- Regulator says proposals to upgrade UK broadband infrastructure will transform the business case for national full-fibre investment in towns, cities and villages.