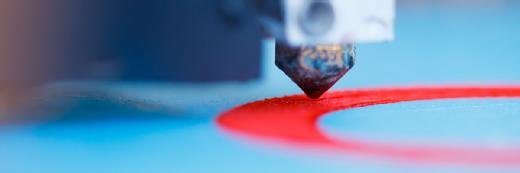

nikkytok - Fotolia

3D print players set to see revenue growth and shipment decline over the next year

The 3D print market closed out the fourth quarter of 2022 with flat or falling shipments, with the focus now turning to improving revenues

A few years ago, 3D printing was regularly talked about as being technology that would reap rewards for the channel. The pandemic had an impact on this, and the struggles of printers to break out of niche applications and hobbyist markets also limited the commercial impact for partners.

An analysis of the last quarter of 2022 from Context saw volumes of 3D shipments fall, with the industry reseting its expectations for this year as a result.

The dynamics of the market with inflation pushing prices up has meant that although shipments have dropped or stalled, the revenues from the units that have been sold are rising.

“While industrial unit shipments dipped, system revenues rose again thanks to inflationary price increases and a shift at the highest end of the market towards more efficient (and higher priced) industrial metal machines,” said Chris Connery, head of global analysis at Context.

“With their end-market buyers still challenged by global inflation and fears of regional recessions, 3D printer vendors across the world have begun to shift their focus from market expansion to profitability and reset their expectations for 2023 to single-digit unit sales growth,” he added.

In the midrange system market, Q4 2022 delivered a 20% increase in shipments year on year (YoY), with most of that growth coming organically due to demand for fresh printers. One price band down at a professional level, where kit costs between $2,500 to $20,000, it was a slightly different picture, with shipments down for a third consecutive time – 12% compared with Q4 of 2021.

The characteristics of the fourth quarter are set to continue to shape the year ahead, with vendors being realistic about shipment versus revenue growth goals.

“While the forecast for 2023 new printer shipments has been pared back, expectations are that revenue growth will once again far outpace unit growth,” said Connery. “Inflation looks set to push prices up even more, and the move toward higher-end metal powder bed fusion machines does not seem to be over.”

Longer term, that exciting vision of a world changed for the better by 3D printing – with supply chains revolutionised by the technology – still remain intact, and those that have invested in the market should still feel confident about the prospects over the course of the decade.

Recent research from GlobaData indicated that there should be an compound annual growth rate (CAGR) of 18% between 2021 and 2030, which would take the value of the market to $70.8bn by the end of that period.

Carolina Pinto, thematic intelligence analyst at GlobalData, said that the market dynamics were being challenged. “3D printing has always been closely associated with prototyping and short production runs,” said Pinto.

“Today, the industry wants to expand into mass manufacturing. To facilitate this transition, 3D printing companies must guarantee product standardisation, particularly in industries such as automotive, aerospace and healthcare.

“Standardisation covers best practices, regulations and benchmarks that allow production to become infinitely repeatable. Investing in workflow automation tools will be the fastest and most cost-efficient way of achieving this,” she added.