Financing IT purchases

There are a number of ways a new IT platform can be acquired but choosing the right method for your business is key.

Remember those heady days of testing IT equipment and then buying IT to last in a datacentre for five to seven years?

Great, wasn’t it? Now, would you like to bet on equipment being suitable to support your critical applications much further out than 12 months?

In a world of rapidly changing technology – from the basic equipment itself through to the platforms the equipment underpins – the standard approach of using capital funds to acquire IT equipment may have had its day. Luckily, there are a number of different ways that a new IT platform can be acquired.

At the end of 2012, Quocirca carried out research for BNP Paribas Leasing Solutions, to find out how organisations gained funding for general corporate expenditure.

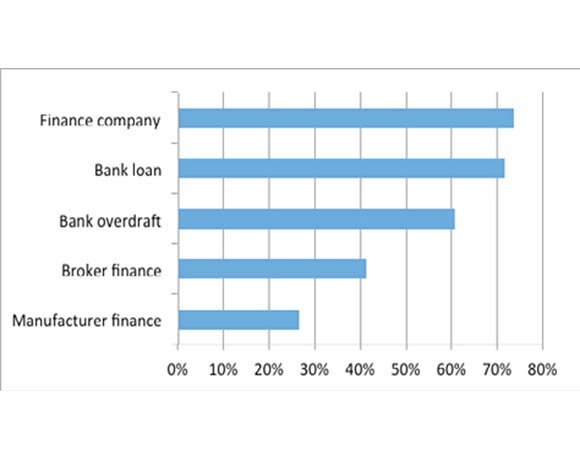

Figure 1 shows that multiple approaches were being used, with finance companies and bank loans being the predominant sources for funds.

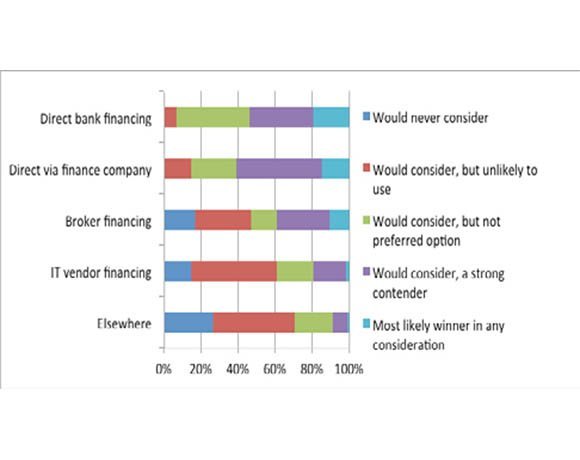

When asked which source of funding was most likely to be used for IT equipment, bank financing won through, as shown in Figure 2 . However, only banks and finance companies received over 50% of responses as a likely winner or strong contender, which suggests external IT financing is still not seen as strategic by many.

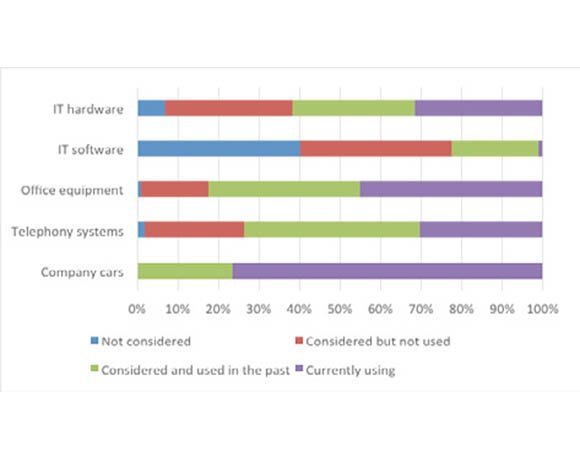

This can be seen in Figure 3. Whereas 77% of organisations were using financing for company cars and 45% were using it for office equipment, only 31% were using it for IT equipment, with the same number having used it in the past.

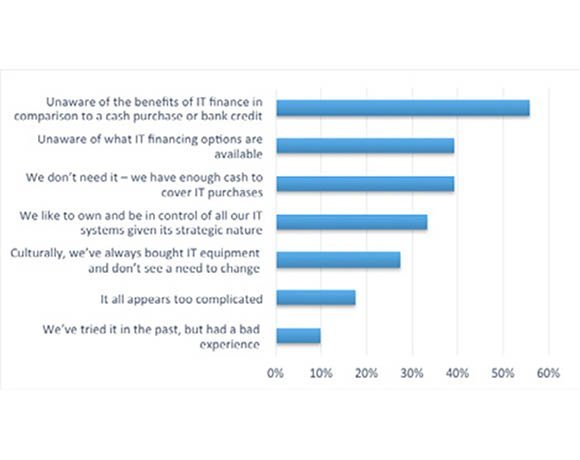

The reasons given as to why IT equipment financing is not being used turned up some interesting findings as well (see Figure 4). Lack of awareness is the main reason, followed by organisations saying that they are cash rich enough not to need finance. This is unlikely for major projects, however, and is more likely to indicate a lack of awareness of what a well managed financing agreement can offer.

Financing an IT purchase

For the moment, let us assume that you still want to own the equipment – whether this is in your own datacentre or a co-location facility. Therefore, you want to purchase the equipment outright. This means a capital expenditure, or capex, but where will the money come from? It is fine if your organisation has the requisite funds, but many will need to obtain funding from elsewhere.

This tends to mean obtaining a loan of some sort. A bank loan may seem the most obvious approach, but as many are finding, the banks are not well disposed to handing out money at the moment. Also, many banks will want to take a guarantee against failure of the organisation to maintain repayments against the loan. This may not be just against the IT equipment itself, as the depreciation of these assets may mean the bank will not be able to recoup its losses. Therefore, you could find yourself having to put other corporate collateral up against the loan – for example, the company’s offices, or the directors may even have to underwrite the loan with personal assets.

Banks have little interest in the reason for a loan being taken out – the main focus for them is ensuring that any risks are minimised, and they will therefore have little interest in you as an organisation. Wherever possible, Quocirca recommends that bank loans are avoided for IT purchasing.

A better approach is to look at how a purchase agreement can be put in place with a focused provider. For example, BNP Paribas Leasing will provide money for an organisation to spend against its IT needs, where the collateral remains just the IT equipment. For an organisation, such an approach enables it to aggregate its own IT spend over a longer period – say, three years – but have access to the total funds up front. This allows for better management of an IT estate and for investment in bigger IT projects than would be possible where the budget would only be available as smaller amounts on an annualised basis.

Leasing IT equipment

Then there is equipment leasing. Here, the assets are not purchased outright, but are “rented” from a company. Many of the IT equipment suppliers have their own IT financing divisions which include leasing. Others, such as GE Capital, BNP Paribas Leasing and Kelway offer a more heterogeneous service where the organisation using the leasing have more choice over the equipment they can use.

At the end of the lease period, there is often the option to purchase the equipment, or to hand it back to the lease company. Be careful of leases where the purchase of the old kit is a requirement – the final “balloon” payment may well be more than the actual value of the equipment, and attempting to sweat old assets to gain any further business value from them is not a realistic approach these days, as three-year old kit will have been superseded many times over. “Evergreen” options are available, where at the end of the lease period, a new lease can be applied against more modern equipment to maintain a relatively modern platform.

IT services

There are companies that specialise in IT lifecycle management (ITLM). Here, service providers such as Bell Microsystems will work with a company to optimise its IT platform and use residual values of existing equipment to part fund the acquisition of new equipment.

By identifying the “sweet spot” before the residual value of existing equipment falls below a certain point, equipment churn can be kept to a point where the capabilities of the underlying IT platform are maintained to very high levels. Bell can source IT equipment as part of an agreement, and will work alongside a financing company where appropriate. Bell will also take on the management of the platform if required.

Hosted IT platforms

The other option is to dispense with the need to purchase IT equipment at all. Cloud computing and hosting service providers can take away the need to acquire, run and manage anything from the bare metal through to a complete stack through the provision of infrastructure, platform or software as a service (I/P/SaaS).

As the hardware assets belong to the service provider, it is up to them to ensure that the platform is fit for purpose. Ensure that you negotiate a meaningful and measurable service level agreement (SLA) and insist that the provider makes the right investments to meet the terms of the SLA.

IT strategy

Investment in an IT platform needs a strategic approach. Any organisation needs to make decisions as to whether it is looking to a capex (capital expenditure) or opex (operating expenditure) approach and then consider what options are available to it.

Where an organisation decides that it still wishes to own the equipment, a budget aggregation lease programme alongside an ITLM service may provide the best option.

For those organisations that wish to divest themselves of any issues around IT equipment ownership, then the cloud or hosting is a valid option.