Using AI to discern if enterprises are walking the talk on ESG

In this guest post, Diana Rose, head of environmental, social and governance (ESG) research at ESG data analysis firm, Insig AI, sets out how artificial intelligence technology can assess whether firms are all talk and no action on sustainability.

In the transition to net zero, the investment community needs ESG information that allows them to meaningfully appraise a firm’s progress against targets and, in turn, be able to hold them to account. However, there are complaints of ‘aggregate confusion’ from investors around the myriad of ESG ratings, using a range of different approaches to adding up data points into ESG scores.

Artificial intelligence (AI) is emerging as a powerful tool in the evolution of meaningful ESG assessment, revealing more granular snapshots of data, such as whether companies are fulfilling their net-zero promises.

Assessing ESG ratings

ESG scoring has enormous potential to unlock a significant amount of information on the management and resilience of companies when pursuing long-term value creation. It can also represent an important market mechanism to help investors better align their portfolios with environmental and social criteria that match with sustainable development.

However, the investment community is faced with the dilemma of ESG ratings varying strongly depending on the provider chosen. This happens for reasons that are often obscured in the methodology and aggregation of data, such as different frameworks, key indicators and metrics, data quality, qualitative judgement, and weighting.

These differences make it nearly impossible for investors to have confidence in the way they are managing the material ESG risks within their investment mandates, and can lead to missed opportunities as well as nasty surprises.

AI supports the thoughtful analyst

At the global business and political summit of COP26, a key focus area was around strengthening the impact of ESG investment, calling for greater efforts toward transparency, consistency, and comparability, alongside the announcement of a convergence of reporting standards.

Attention was placed on corporate disclosures as the real temperature check, both for businesses and the investors that finance them.

However, gathering evidence from corporate disclosures is a combination of quantitative science and qualitative art, which places a high demand on the time and efforts of the analyst.

While the bar is being raised in ESG assessment, AI has also been busy, fast developing into a versatile partner for the investment analyst. Machine learning is a branch of artificial intelligence based on the idea that systems can learn from data, identify patterns and make decisions with minimal human intervention; and it’s becoming more available. The advent of cheaper off-the-shelf algorithms, combined with advances in computational power, mean investment managers and analysts have new superpowers.

This has not gone unnoticed by the powers driving UK PLC’s transition to net zero – The Task Force on Climate-related Financial Disclosures (TCFD) is a disclosure body who itself uses AI to verify whether large number of organisations include its recommendations in their reports.

Proprietary machine-learning models can process and visualise huge amounts of messy qualitative data, taking a lot of the grunt-work out and enabling more transparent, robust and timely analysis. When directed thoughtfully, the insights that AI offers can enable investors to make more informed investment decisions and reduce the dependence on a high-level ESG score.

Directions of travel

One of the more insightful ways to consider ESG data is to analyse change over time through a company’s disclosure history – this can reveal gaps that may flag up greenwashing, as well as meaningful improvements compared to a peer group. A search for trends like this is just one example of analysis that’s painful to tackle manually but lends itself beautifully to technology.

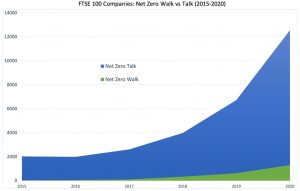

To illustrate this, let’s take a look at the collective volume of the FTSE 100’s net zero-related disclosures across all reports published since 2015. Using a keyword approach, we can class these into generic terms, labelled ‘Net Zero Talk’, and phrases that carry more weight and accountability, ‘Net Zero Walk’.

The two trajectories are striking, and when this analysis is taken down to company level, this data equips investors with a new perspective on the gap between rhetoric and accountability, so they have better agency to ask the right questions.

Fig 1. Count of Net Zero related phrases mentioned each year in Annual Reports, Sustainability Reports, ESG documents and Earnings Call Transcripts. Net Zero Talk: ‘net zero’, ‘low carbon’, ‘climate change’; Net Zero Walk: ‘science based target’, ‘climate scenario’, ‘decarbonisation’, ‘carbon transition’,’climate transition’. Source: InsigAI

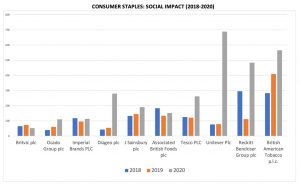

Given the high materiality and profile of workforce issues such as human rights, diversity and pay among certain sectors, using AI to view disclosures with a social lens is also revealing. Changes in the social narrative of the consumer staples sector of household names between 2018 and 2020 show the scale of the gap between apparently leaders and laggards on social disclosure, particularly with some companies accelerating their reporting significantly in 2020.

Fig 2. Count of social impact related phrases mentioned each year in Annual Reports, Sustainability Reports, ESG documents and Earnings Call Transcripts. Phrases: ‘human rights’, ‘forced labour’, ‘diversity’, ‘pay gap’. Source: InsigAI

Nowhere to hide

Geopolitical summits like COP26 have made it clear that the spotlight is firmly on company disclosures regarding net zero, with the idea that those driving the transition are rewarded by the market. This requires investor scrutiny. Science-based metrics are essential, but so is the qualitative assessment of the context and direction of travel contained in disclosures.

Stock-pickers are pouring more and more into companies making most progress regarding ESG, so the potential for greenwashing will increase. Last year, the UK’s Competition and Markets Authority found that 40% of environmental information on corporate websites was deemed to be misleading.

By using machine learning algorithms and natural language processing, businesses and investors now have tools at their fingertips to surface and expose evidence of empty promises and hold companies to account. In the evolution of the ESG space, the benefits of access to powerful technology to decision-makers is playing its part. Now it’s time to read between the lines to find who’s really going to move the needle.